How to Find Multibagger Stocks in India: 10 Proven Strategies for 2025

April 20, 2025 | by info@biztrendwire.com

What is a Multibagger Stock?

A multibagger stock is one that multiplies your investment — often by 2x, 5x, or even 10x — over a few years. Think of early investors in Titan, Infosys, or Dixon Technologies. These were small or mid-cap stocks once… now they’re giants.

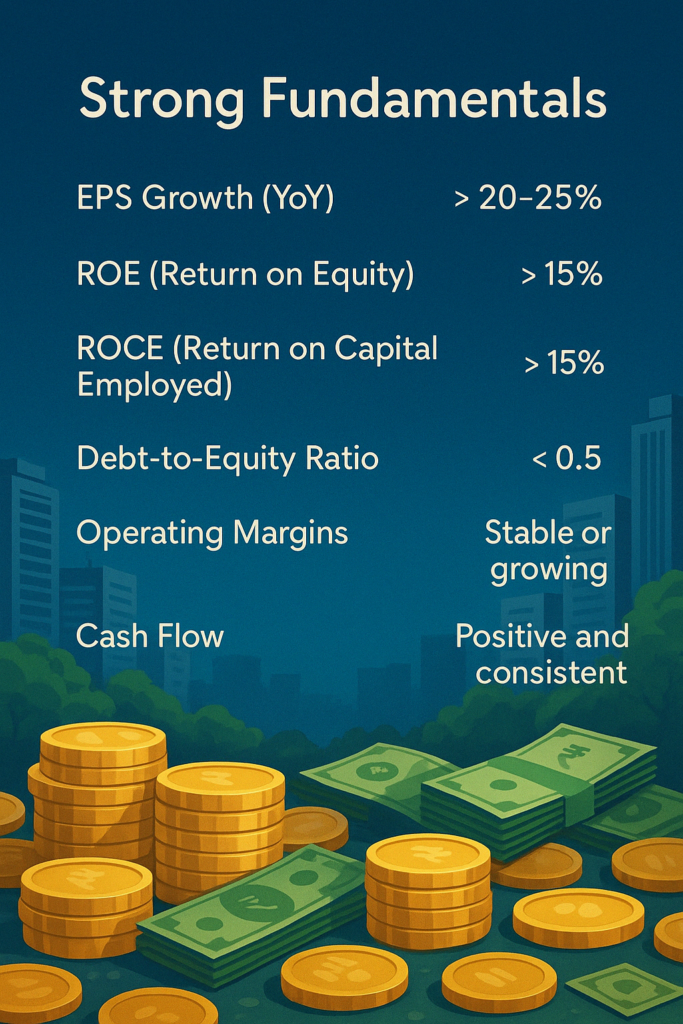

✅ 1. Look for Strong Fundamentals

The best multibagger stocks are backed by solid financials. Here’s what to look for:

EPS Growth (YoY) > 20–25%

Indicates the company is rapidly increasing its profitability year over year.

ROE (Return on Equity) > 15% consistently

Shows efficient use of shareholders’ capital to generate profits.

ROCE (Return on Capital Employed) > 15%

Reflects how well the company uses its total capital to generate earnings.

Debt-to-Equity Ratio < 0.5

Signals a low reliance on debt, ensuring financial stability.

Operating Margins: Stable or growing

Highlights strong control over operating costs and pricing power.

Cash Flow: Positive and consistent

Confirms the business generates sufficient real cash to sustain operations and growth.

Tools:

Screener.in Tickertape Trendlyne Moneycontrol

2. Focus on Small & Mid-Cap Stocks

Large-cap stocks rarely turn multibagger fast. Instead:

- Look for companies with market cap < ₹10,000 Cr

- Smaller base = higher growth potential

You can filter small and mid-cap stocks using Market Capitalization Filter – Screener

3. Spot Sectors with Tailwinds

Multibaggers are often found in booming or emerging sectors. Watch these themes in 2025:

- Electric Vehicles (EV)

- Green energy and solar

- Specialty chemicals

- Pharma & diagnostics

- Railways and Defense

- AI & Automation

- Real estate and infra

Track government incentives via Make in India and PLI Scheme updates on PIB.

4. Find Competitive Moats

A company with a moat enjoys a lasting edge — brand, patents, distribution, tech, etc.

Solid management quality (check Annual Reports)

Look for consistent market leadership

Strong R&D, patents, or exclusive supply chains

5. Check Promoter & Institutional Holdings

| Factor | What to Look For |

|---|---|

| Promoter Holding | High & increasing |

| FII/DII Holding | Entry or rising stake |

| Pledging | Avoid high pledging |

Use Trendlyne Shareholding Data, BSE Shareholding Pattern, or NSE Shareholding Reports to verify.

6. Don’t Overpay – Check Valuation

Growth is good, but valuation matters too. Key ratios:

- PE Ratio (compare with sector average on Screener)

- Price-to-Book Value

- PEG Ratio = PE / Growth Rate

Look for GARP (Growth at Reasonable Price) strategy companies.

✅ 7. Watch Historical Price Trends

- Use platforms like TradingView or Chartink to analyze charts

- Multibaggers often consolidate before breakout

- Use technical indicators for smart entry points

8. Avoid These Red Flags

Stay away from:

- High equity dilution

- Fraud news or poor governance (SEBI Updates)

- Consistently negative cash flows

- Operator-driven stocks with low volumes

9. Follow Smart Investors

Track India’s top investors and their stock picks:

Use Trendlyne’s Super Investors Tool to follow them live.

✅ 10. Be Patient — Let It Compound

Multibaggers aren’t made in months. They grow over 3–5+ years. Don’t panic on short-term dips. Track business performance, not just price movement.

Bonus: Free Screener Custom Query

Use this on Screener.in to find small-cap gems:

Capitalization < 5000 AND

Return on capital employed > 15 AND

Sales growth > 15 AND

Debt to equity < 0.5 AND

Promoter holding > 50 AND

Price to Earning < 30

Finding a multibagger in the Indian stock market requires research, patience, and courage. Focus on quality businesses, back the right sectors, and give your investments time to grow.

Latest Business News Today: Stock Markets, Financial News, India Business & World Business News Check latest updates on business, finance, budget and economy from across the world. Get daily updates for BSE Sensex, Share price, Stock markets, BSE, NSE, Nifty, business news on various sectors and much more from Times of India Business.

- Trump’s tariff reset: From Canada to Laos, even dealmakers face higher costs as legal fight brews; US allies & rivals hit with steep import taxes under new trade rulesby TOI Business Desk on August 2, 2025 at 4:38 pm

Donald Trump's new tariff policy is creating economic problems worldwide. Countries face high import taxes unless they agree to new trade deals with the US. Experts say everyone will lose, including US consumers. Some nations are negotiating, but still face higher tariffs. Lawsuits are challenging Trump's authority. US businesses and consumers will likely pay more for goods.

- Berkshire Hathaway Q2 results : Warren Buffett’s company profit halves after $3.76bn Kraft Heinz writedown; Q2 net slips to $12.37bn from $30.25bn YoYby TOI Business Desk on August 2, 2025 at 3:10 pm

Berkshire Hathaway's second-quarter profit plummeted 59% to $12.37 billion, impacted by a $3.76 billion writedown on its Kraft Heinz investment. Despite this setback, operating profit only marginally decreased to $11.16 billion, surpassing Wall Street expectations. While Buffett confirmed his eventual CEO departure and BNSF showed strong performance, the company's substantial cash reserves remain untouched due to high valuations.

- Mahindra-SML deal: M&M acquires 58.96% in SML Isuzu for Rs 555 crore, renames it SML Mahindraby TOI Business Desk on August 2, 2025 at 2:20 pm

Mahindra & Mahindra has finalized its acquisition of a 58.96% controlling stake in SML Isuzu for Rs 555 crore, renaming it 'SML Mahindra Ltd.' This move aims to significantly expand M&M's presence in the >3.5-tonne commercial vehicle category, targeting a market share increase to 6% immediately and a long-term goal of over 20% by FY36.

RELATED POSTS

View all